Unlocking the Power of Real-World Assets: A Step-by-step Guide to Vaults and dTokens

So you got the theoretical side of decentralized assets down after reading our last post. Nice! Now it's time to get your hands dirty and actually put that knowledge into practice.

In this blog, we'll take you on a tour of the DeFiChain mobile app and show you exactly how to mint (create) your own dTokens using the Vault system. By the end, you'll be a dToken minting pro!

Don't worry if some of the terms still seem confusing at first. This tutorial's hands-on approach will make everything click into place. too!

How to create a vault

Before we start, make sure you've updated to the latest app version. Having the newest version ensures all the app's features work smoothly. We want you to have the full DeFiChain experience!

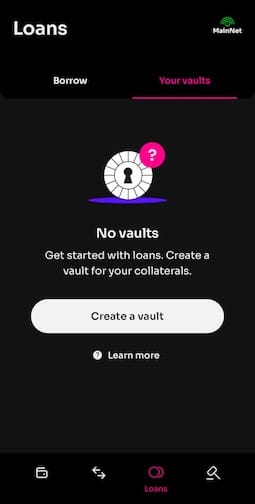

The home screen is command central for creating Vaults and taking out decentralized loans. As we covered before, setting up a Vault to store your crypto is step one for minting those sweet decentralized assets (dTokens).

So let's create a new Vault right now by tapping that "Create a vault" button. Once you do, you'll see this screen:

The first thing it'll ask is what loan scheme you want for the Vault. This determines the annual interest rate you'll pay on your loan based on the minimum collateralization ratio (we'll get into this shortly).

The loan is paid out in dTokens and you can check the full list of mintable dTokens on DefiScan.live.

From there, you can hold those dTokens, trade them on the decentralized exchange (DEX), or add them to liquidity pools to earn high returns through liquidity mining. The crypto world is your oyster!

The collateralization ratio shows how much your deposited collateral (in DFI, DUSD, dBTC, dETH, or stablecoins like dUSDT, dUSDC, dEUROC) is worth compared to the dTokens you mint. Higher ratio = less loan interest.

To calculate it: (Total Collateral Value) / (Total dToken Value) x 100 = Collateralization Ratio

If you want to pay as little interest as possible on your loan, you should choose a minimum collateral ratio that is as high as possible. But be careful that your collaterallization ratio does not drop below this threshold. Otherwise, your Vault will be put into liquidation and subsequently auctioned off to the highest bidder, along with all its collateral. We will now proceed with the minimum collateralisation level of 150%.

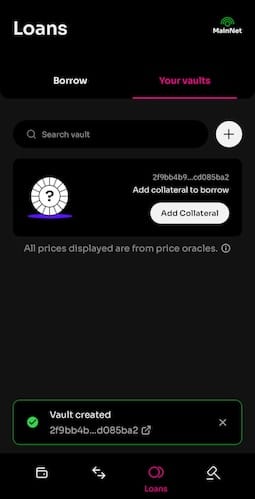

The creation of your Vault can take some time, as the Vault has to be created as a "transaction" directly on the blockchain. Once the vault has been created, you should see the following screen, in which you can see the confirmation message of the successful creation of your Vault:

How to add collateral to your Vault

Congrats! With just a few clicks, you've created your first Vault. But before you can use it to mint dTokens (decentralized assets), you'll need to deposit some collateral.

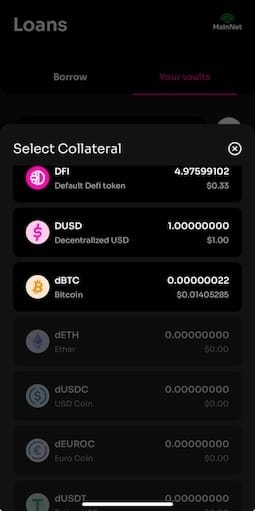

To do this, simply click on your new Vault and tap the "Add Collateral" button in the middle of the screen. You'll then be able to select which coins you want to put up as collateral from this list:

Pick your collateral, set the amount, and confirm the transaction. As soon as it's processed, you'll see those coins in your Vault acting as your collateral backing.

The total value of those deposited coins represents your Vault's collateral pool. With that pool secured, you can start minting dTokens against it!

Head back to your Vault and click on the "Borrow" tab. If the "Borrowed" section is empty, that means you haven't taken out any dToken loans using your collateral yet.

To change that, select the dTokens you want to mint using your Vault's collateral value as backing. Check DefiScan.live for the complete list and all the latest stats on these tokens.

For practice, let's mint some DUSD - that's the token commonly paired for liquidity mining with other dTokens.

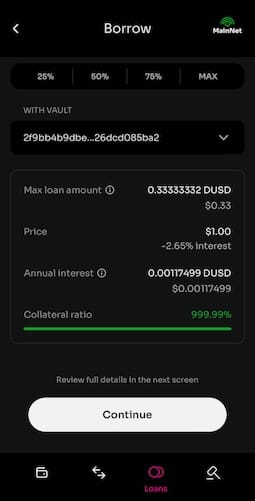

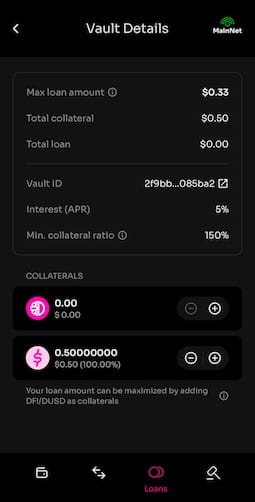

This will show the maximum loan amount, the current minting price (pulled from decentralized Oracle data), the interest rate for that dToken, and the details on your Vault's collateral/loan status.

Let's keep it simple and mint just 0.05 DUSD for now. With that amount entered, you'll see the estimated collateralization ratio at the bottom. This is hugely important - it HAS to stay above the minimum 150% to avoid liquidation.

With our 0.05 DUSD example, the ratio is a safe 999%, so we're good to go! Hit "Continue" and confirm it in the next window by clicking on “Borrow.”

Once it's done, you'll have a new DUSD loan appearing in your Vault. The unused portion of your collateral will still be available for further loans/minting.

Be sure to monitor your collateralization ratio going forward. Your Vault is safe from liquidation as long as you stay well above that 150% minimum line.

That's the basics! Now that you've deposited collateral and minted your first dToken, it's time to explore further and take advantage of everything DeFiChain has to offer.

What can I do now with my dTokens?

You've taken the first big step and minted some fresh dTokens using your Vault. But the fun's just getting started! Now we're about to dive into the really exciting stuff.

The value of any given dToken is based purely on supply and demand over on the decentralized exchange (DEX). However, prices will generally be tracked closely with similar assets traded on external exchanges.

So, what can you actually do with these new dTokens? Well, you've got a few options:

- Buy dTokens directly on the DEX: If you see a dToken you like, you can simply purchase it through the DEX and hold it, allowing you to ride any price appreciation. Just like buying stocks!

- Trade dTokens on the DEX: Alternatively, you can use your dToken holdings to engage in active trading on the DEX.

- Liquidity Mining with dTokens: But here's where things get really juicy... You can also take those dTokens and put them to work in liquidity mining pools! Earn interest and trading fees just for providing liquidity.

Whether you're looking to go long, short, or somewhere in between, dTokens open up a world of possibilities. The decentralized finance possibilities are endless!

Liquidity Mining

You've already heard about liquidity mining with BTC, ETH, and other cryptocurrencies. Well, get ready, because with the dTokens you just minted, you can tap into an entirely new stream of passive income!

Unlike the previous liquidity pools powered by DFI pairings, the dToken pools use DUSD as the second coin. So if you want to supply liquidity for a dToken pool like dTSLA-DUSD, you'll need an equal value of both dTSLA and DUSD tokens.

But don't worry, we've got you covered there too! Remember that DUSD you minted earlier from your Vault? We can put that to work by earning interest and fees by supplying them to the DUSD-DFI liquidity pool.

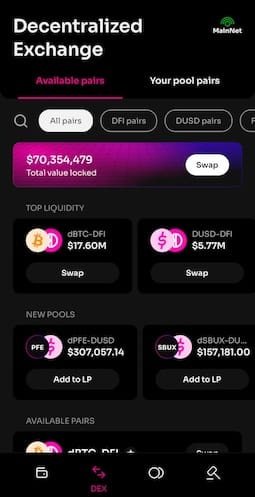

To get started, just head to the DEX section of your DeFiChain mobile wallet and scroll down until you see the DUSD-DFI pool listing. Tap on the pool pair and scroll down to “Add liquidity”

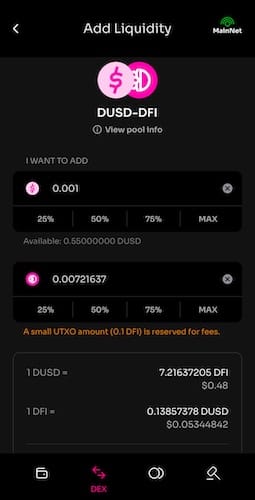

You'll then be prompted to enter the DUSD amount you want to supply. The app will automatically calculate the matching DFI amount required.

Once you confirm the add liquidity transaction, you're officially liquidity mining and will start earning regular rewards paid straight to your wallet with every new block.

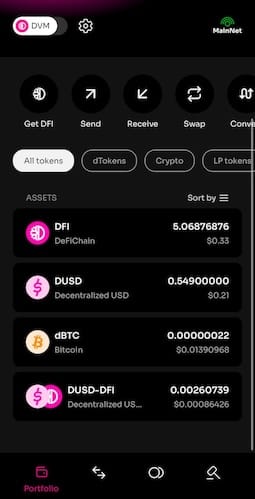

If you go check under "Balances" now, you'll see a new "DUSD-DFI" entry representing your share of that liquidity pool. The good thing is that your dTokens are now liquidity mining and generating a passive income.

This is just the beginning, though. With your Vault set up, you can keep minting new dTokens against that collateral and join even more liquidity pools. The dToken world is your oyster for stacking those Liquidity Mining returns!

Even if the markets take a dip, you can always add extra collateral and mint more assets to counterbalance.

Repaying your loan and closing the vault

Ready to pay back that dToken loan and close up your Vault? No problem here's what you need to do:

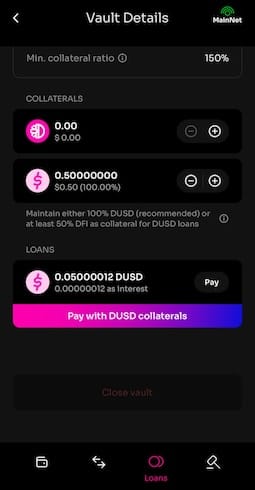

First, head to the "Loans" section in your DeFiChain wallet and go into your Vault. Tap on your Vault, and you'll see the details of your current loan, including any interest that has accumulated since you originally minted those dTokens.

To start the pay back process, scroll down until you see your open loans and click "Pay". This will take you to a screen where you can specify how much of the outstanding loan you want to repay. Since we're closing the Vault entirely, we need to pay back the full loan amount, including interest.

Conveniently, that total amount owed should already be pre-filled, so you can just tap "Continue" and then confirm the payback transaction on the next screen. This may take a little while to process on-chain.

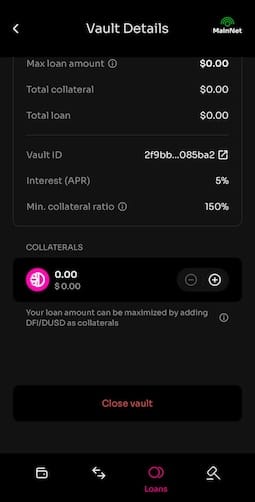

Once that's settled, we need to withdraw the collateral you originally deposited from the Vault. Go back to your Vault's overview and scroll down to the “Collateral” section. In our example, that was 0.5 DUSD.

Your Vault should be completely empty with the collateral out and the loan paid off. The final step is closing it. Just click on your Vault and scroll down until you see the "Close Vault" button.

You'll be prompted to pay a small 1 DFI fee to complete the closure. But after confirming that, the Vault is officially closed! You should no longer see it listed under "Loans" once the transaction is finalized.

If any part of that was confusing or you have additional questions, no worries! Our awesome DeFiChain community on Telegram is always happy to help guide you through the process.